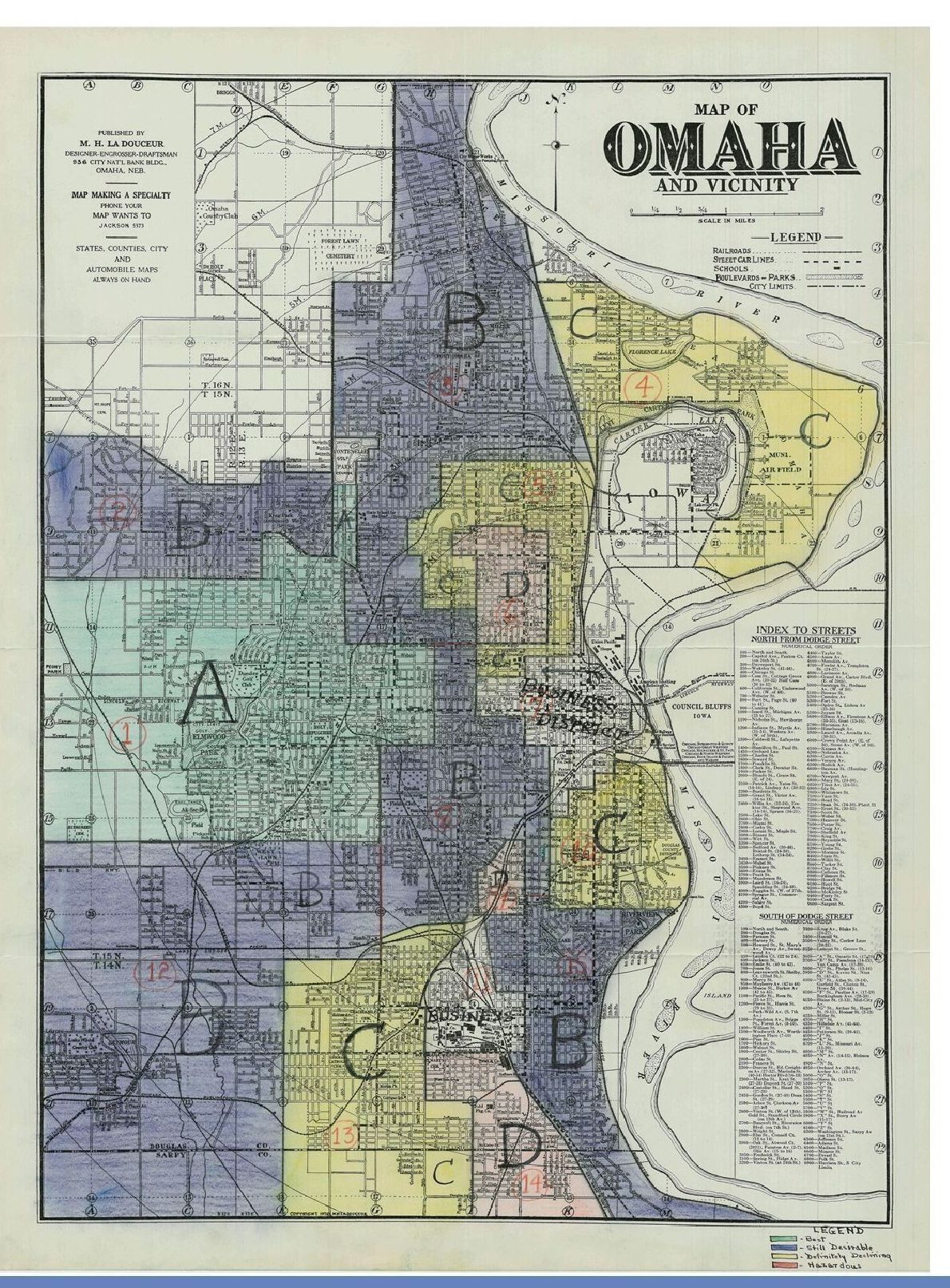

We are very excited to announce the Greenlining Fund, which will be officially launched on June 19, 2023. The Greenlining Fund has been designed to provide intentional, community-led reinvestment to Eastern Omaha and will direct resources to create or maintain homeownership in areas that have experienced decades of historical disinvestment through policies and practices including redlining.

The first of its kind in Nebraska, the Greenlining Fund is also one of only a few national large-scale funds focused on addressing deeply rooted systems of racial bias, discrimination, and segregation.

Front Porch Investments prioritizes centering historically excluded voices in decision-making and program design within the Greenlining Fund. The inaugural cohort of the Community Advisory Committee, formed in November of 2022 with 14 community members, led in selecting the fund’s first pilot project, the Home Equity Loan Fund, and designed the program’s parameters, eligibility, and prioritization.

“While other programs exist across the country to offer home equity loans and property tax relief, the innovation of explicitly reinvesting in formerly redlined areas of a community and inviting members from that very community to share power and decision-making sets FPI’s Greenlining Fund apart. This intentionality and commitment to explicitly address past discriminatory housing policies sets precedent for future programming in Omaha, and in cities across the country,” said Meridith Dillon, executive director of Front Porch Investments.

The pilot program offers 0% interest rate home equity loans, up to a $50,000 maximum per property address, supporting homeownership stability and displacement efforts. Loan amounts are subject to available funds, with eligibility factored from debt-to-income ratios and loan-to-value ratios. Funds may be used for home repair, exterior improvements, home renovation, modifications for aging in place, and energy efficiency improvements. Blair Freeman and Project Houseworks will offer general contractor services for homeowners’ projects for home renovation and repair.

“The Community Advisory Committee researched, reviewed and ultimately decided on home equity loans for renovation and repair as the pilot launch program for the Greenlining Fund, based on the number of homeowners that could benefit from the current funding available,” said Maxwell Morgan, Community Initiatives and Outreach Manager, Front Porch Investments.

Interested homeowners with properties located in formerly redlined census tracts may submit an online program eligibility interest form between June 19 and July 10, 2023. Eligibility requirements include geographic location and income considerations, with prioritization given to Black, Indigenous, and other people of color (of ancestry, race, and or ethnicity who were harmed and impacted by redlining practices) whose homes are located within a census tract formerly redlined. Up to 40 eligible submissions will be randomly drawn and invited to apply for the home equity loan through Impact Development Fund, a nonprofit CDFI (Community Development Financial Institution) with decades of experience in providing loans for affordable housing programs, who will underwrite, originate, monitor and service the loans as well as provide monthly reporting on all loan payments.

As home equity loan funds are repaid, the funds will revolve permanently in Qualified Census Tracts of North and South Omaha to support homeowners on the east side. Following completion of the pilot program, the Committee will participate in an evaluation to determine changes or recommendations for future investments in the community based on applicant feedback and program goals and outcomes. The next area of focus for the Greenlining Fund will include research and investments for property tax relief and homestead exemption expansion as a potential displacement prevention strategy during a time of historic reinvestment in Eastern Omaha.

Front Porch has committed $1M to the launch of the home equity loan fund pilot, with an additional $4M designated to future investments. Additionally, Front Porch is a current semi-finalist for $3M in national funding through Enterprise and the Wells Fargo Foundation, to support the Greenlining Fund’s expansion into other impact programs. Front Porch Investments will continue to pursue local and national funding opportunities to continue to support this community-led fund and address racial equity issues in homeownership through the Greenlining work.

For eligible homeowners interested in more information, open house community education events will be held, which are not mandatory or required, on June 27, 2023 and June 28, 2023. For dates and additional details, visit the home equity loan fund webpage.

Resource: Address lookup tool, provided by MAPA