Greenlining Fund Initiatives

The Greenlining Fund, under the guidance of the CAC, seeks to help prospective or current homeowners with an emphasis on wealth creation and displacement prevention.

Current investments include the following:

Home Repair and Renovation

Home Equity Loan Fund Pilot

The Greenlining Fund and the CAC launched a Home Equity Loan Fund (HELF) Program in summer 2023 to support households with home repairs and renovations by providing zero-interest financing up to a $50,000 maximum per property address, fully amortized over a 30-year term. Interest forms were compiled and reviewed by Front Porch staff and the CAC. Front Porch and the Community Advisory Committee then selected 35 homeowners who were invited to apply for a loan. Following loan approval, Front Porch worked with applicants to select a general contractor to complete all home repairs and renovations.

The HELF Program is administered by Front Porch in partnership with Impact Development Fund (IDF), which serves as the direct-to-consumer loan originator and servicer. Funds are dispersed via contractor invoices and/or vendor receipts, directly to the contractor and can be used for home repair, exterior improvements, home renovation, modifications for aging in place, and energy efficiency improvements.

The Home Equity Loan Fund interest period has now closed, and interest forms are no longer being accepted for the HELF Program.

No-Cost Home Repair Program

In 2024, the CAC elected to launch a no-cost home repair program to provide home renovation and repairs to eligible homeowners. The following organizations are currently funded to provide services:

Canopy South: Prospective clients can call the main line at 402.916.9293 or email info@canopysouth.org.

Homewoven: Prospective clients can call the main line at 402-965-9201 or email Amanda Carrico at amanda@homewoven.org to get more information on our programs and to apply.

Habitat Omaha: Prospective clients can learn more here: Habitat Omaha Home Repair Program.

Eligible homeowners must meet the following criteria:

- Be the owner of a single-family residential home, occupied as a primary residence.

- Have an income not exceeding 80% of the area median income (AMI) for the Omaha Metro, adjusted by household size (using HUD Omaha-Council Bluffs, NE-IA Metro FMR Area).

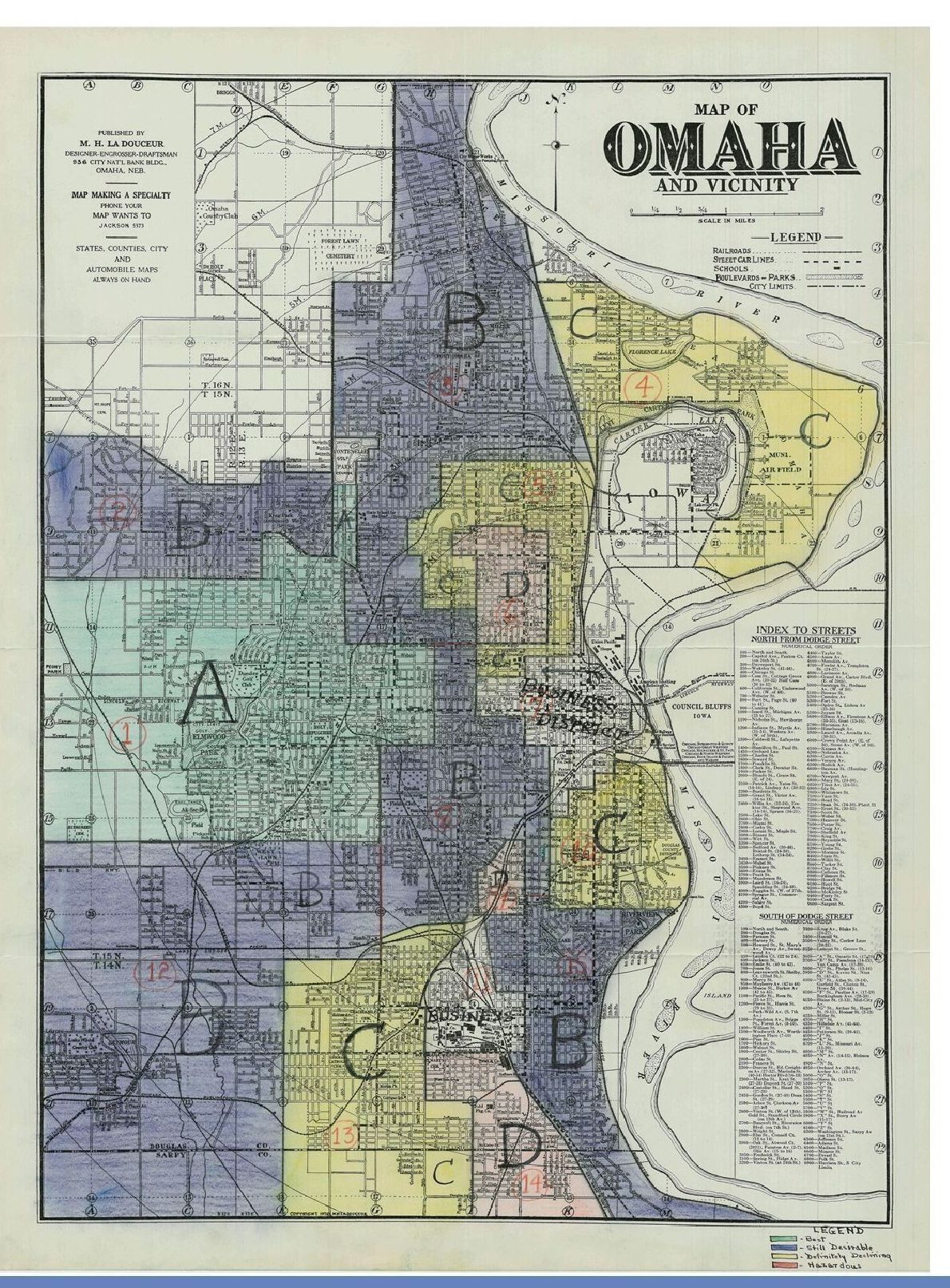

- Reside in formerly redlined census tracts in Northeast or Southeast Omaha (marked Hazardous-red or Definitely Declining-yellow). (click here to look up your address)

In case of high application volume, the following will receive priority consideration:

- Homes located in areas marked Hazardous (red)

- Long-term residents (10+ years)

- Properties with family ownership or inheritance history

Property Tax Relief

The Greenlining Fund is also concerned with rising property taxes in revitalization areas with escalating property values which threaten to displace low-income homeowners. In fall 2024, the CAC partnered with Volunteers Assisting Seniors to support increased outreach to seniors to raise awareness of and participation in the homestead exemption program to help reduce property tax costs for older homeowners in formerly redlined neighborhoods.

Homestead Exemption Program

Volunteers Assisting Seniors (VAS) assists with Homestead Exemption filing. Homestead applications must be filed with the county assessor between February 1 and June 30 of each year.

Who Can Qualify for Homestead Exemptions?

- Persons who are age 65 or older before January 1

- Certain physically disabled individuals (mobility disabilities)

- Certain disabled veterans and their widows or widowers

- The home must be owned and occupied from January 1 through August 15.

Homestead exemptions provide relief from property taxes by exempting all or a portion of the valuation of a home from taxation. The State of Nebraska reimburses the counties and governmental subdivisions for taxes lost due to homestead exemptions. The percentage of relief is based on the applicant’s income level and home valuation.

Prospective clients can call VAS at 402-444-6617, or by filling out the VAS contact us link: https://vas-nebraska.org/contact-us/

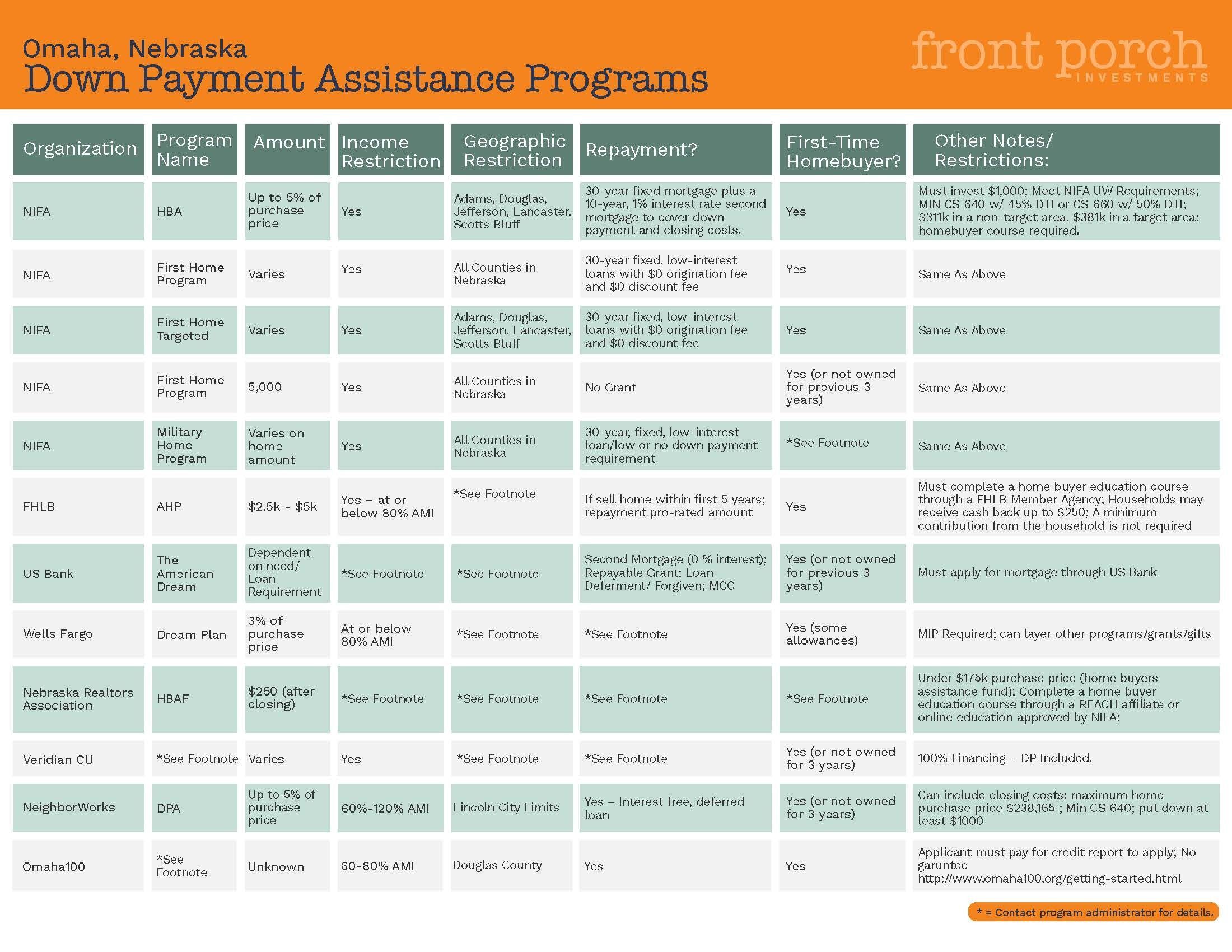

Down Payment Assistance

Down payments can be a significant barrier to homeownership. In fall 2025, the CAC awarded funds to Canopy South to provide down payment assistance to first-time and moderate-income homebuyers purchasing new and rehabilitated houses in South Omaha.

Here are some other local down payment assistance resources:

Additional homeownership resources from community partners:

Habitat for Humanity Omaha Homeownership Program