PROGRAM OVERVIEW

The Development and Preservation Fund is a revolving loan program that helps to finance affordable and workforce housing across the greater Omaha-Council Bluffs Area. Established in response to the Assessment of Housing Affordability, Needs, & Priorities report (2021), the fund provides flexible, low-interest loans for both new development and preservation projects.

The Fund’s structure allows it to offer below-market interest rates, making it a strong partner for projects that might otherwise struggle to secure affordable financing. It also intentionally invests in projects led by emerging or diverse developers to expand access to opportunity across the community. Loan repayments are reinvested into the Fund, creating a self-sustaining cycle that grows its impact over time. In doing so, the Fund not only increases the supply of affordable homes but also supports broader community benefits—housing stability, improved health and well-being, financial security, and educational outcomes.

The Development and Preservation Fund prioritizes projects that:

- Maximize housing affordability

- Encourage innovation

- Invest in diverse developers or businesses

- Target strategic areas of investment

- Promote housing justice and equity

- Engage the broader community

LOAN GUIDELINES

The Development and Preservation Fund provides short- and long-term loans for affordable housing projects at 120% AMI or lower within the Greater Omaha Metro. Applications go through a multi-stage review process, including rigorous underwriting.

LOAN FUNDING OVERVIEW

- Affordable housing development and preservation projects

- Located in the Greater Omaha Metro (Douglas and Sarpy County Nebraska and Council Bluffs, Iowa)

- Loan Range: $200,000–$3,000,000

- Affordability requirements will apply (10-20 year + LURA)

- Loan guaranty requirements apply for all borrowers

- All loans must maintain a minimum DSCR of 1.10x

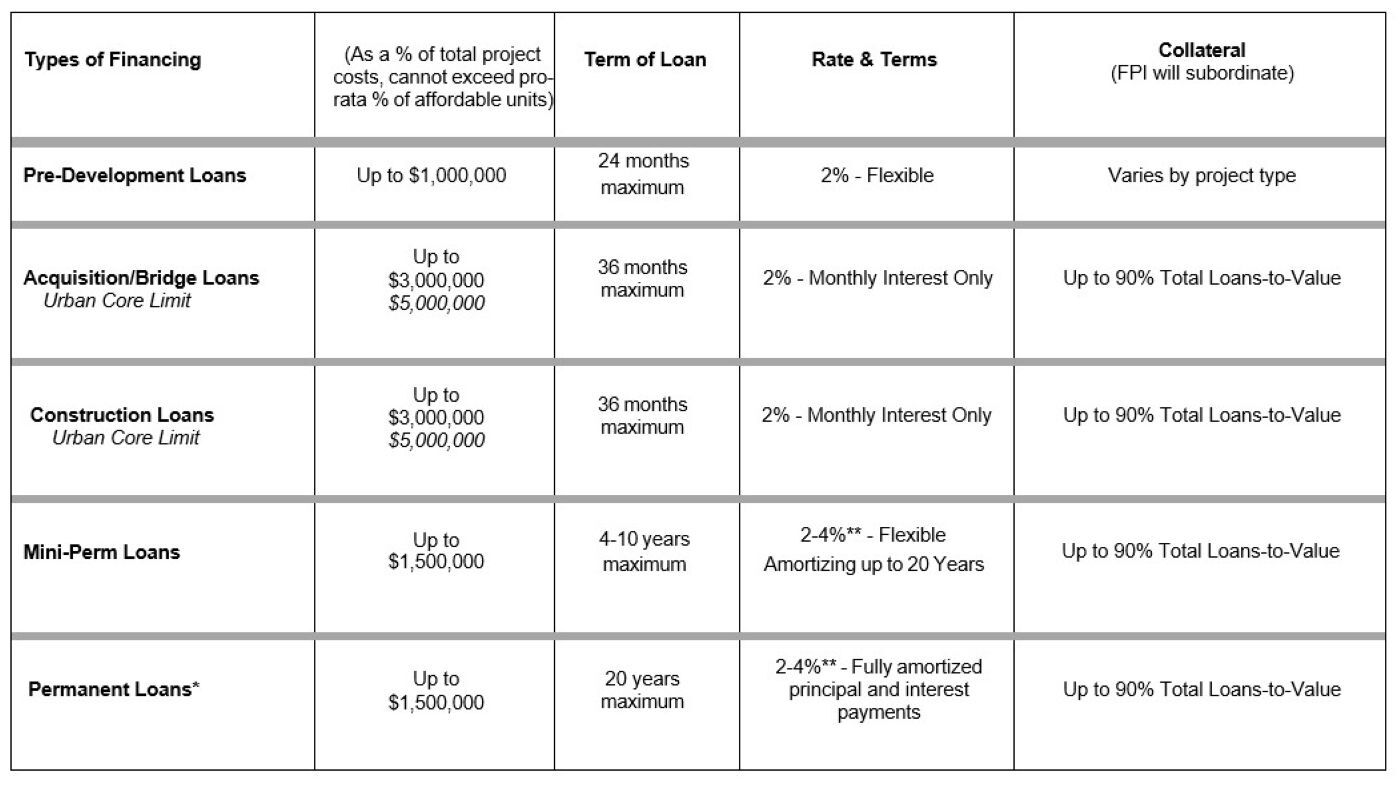

RATES AND FEES: Rates are set at the time of loan approval. Loans are currently provided at a 2-4% fixed interest rate, and origination fees are 1%. Impact Development Fund (IDF) administers the loans on behalf of FPI.

*9% LIHTC Projects are not eligible for Permanent Loans

**To qualify for mini-perm and permanent financing, a minimum of 50% of the units must be set to less than 80% of AMI. The standard interest rate is 4%, but the rate may be decreased by .50% for each criteria met below:

1) 50% of units less than 60% AMI

2) 75% of units less than 80% AMI

3) Project will preserve or rehabilitate an existing building

4) Project is located within a Strategic Target Area - QCT, Revitalization Area, or High-Opportunity Area

ELIGIBILITY

Applicant Eligibility

- For-Profit Developers / Owners

- Nonprofit Organizations

Project Eligibility

- Located in the Greater Omaha Metro (Douglas and Sarpy Counties in Nebraska and Council Bluffs, Iowa)

- New construction, purchase/preservation of existing affordable housing, and rehab/adaptive reuse of an existing structure

- Rental and for-sale housing projects

- Mixed-use and mixed-income projects are eligible, although restrictions on the percentage of funding apply

- Serves households at or below 120% AMI

TARGETED FUNDING OPPORTUNITIES

In addition to the general D&P Fund, Front Porch Investments manages several special or geographically targeted funds designed to respond to unique local needs:

Council Bluffs Fund

Supports both for-sale and rental projects in Council Bluffs and Carter Lake, Iowa, with a focus on loans that strengthen neighborhood stability. All project types are eligible, and funding terms generally mirror those of the general Development & Preservation Fund.

Middle-Income Workforce Housing Fund

Supports for-sale housing in Sarpy County and Qualified Census Tracts in Douglas County. This fund supports the creation of attainable homes for middle-income households earning up to 120% of Area Median Income (AMI). Projects providing higher-density "missing middle" types such as townhomes, condos, and duplexes will be prioritized.

Eligible Activities

- New construction or rehabilitation/adaptive reuse of homes for owner-occupancy

- Predevelopment and site development costs directly tied to for-sale housing

Key Requirements

- Homes must have a total development cost of $330,000 or less per unit

- Loan amounts range from $250,000–$3,000,000 at a 2% fixed interest rate

- Target sale price range: up to $350,000, serving buyers at up to 120% AMI

This program is funded through the Nebraska Department of Economic Development’s Middle-Income Workforce Housing Fund and administered locally by Front Porch Investments.

If your project might align with these priorities, please complete this interest form to start a conversation!

APPLICATION PROCESS

Depending on the project, application timelines may vary.

1 | Pre-Application

If you're interested in applying for funding for your project, please complete the Loan Program Interest Form. Once submitted, our Loan Manager will schedule an initial call to discuss your project details, establish milestones, and outline application timelines and next steps.

The purpose of this pre-application stage is to ensure your project aligns with FPI's investment priorities, meets the eligibility requirements, and is ready for the next stage. Once this stage is complete, you will receive an invitation to formally apply and submit the necessary documents for underwriting.

2 | Application and Underwriting

Applicants will complete an application, including all necessary financial documentation to be considered for funding. Underwriting is completed in collaboration with our partners at Impact Development Fund. Our goal is to complete underwriting within 4-8 weeks of receipt of a final application.

3 | Review and Approval

Applications will be reviewed on a monthly basis and will go through a multi-stage review, including committee review and final approval by the Board of Directors. Funding decisions consider both alignment with FPI's funding priorities and the outcome of project underwriting.

LOAN APPLICANT RESOURCES

Supporting Materials and Links

- GIS Mapping Tool – to identify QCTs and proximity to transit and employment centers

- Area Median Income (AMI) Limits Chart – effective June 1, 2024

- Pro Forma – sample 25-year and 18-year templates

- Business Debt Schedule – sample template

- Draw Schedule – sample template

- Real Estate Owned Worksheet – sample template

- Sources and Uses – sample template

- Small and Emerging Business (SEB) Directory/Search – City of Omaha Human Rights and Relations

Language Accessibility

We have installed a plug-in for language translation on our website, positioned at the top right of this page. If additional language assistance or accessibility supports are needed to apply, please don't hesitate to email hello@frontporchinvestments.org. We proudly partner with World Speaks for translation services, and Front Porch will cover the cost of pre-approved services during application periods.