Affordable Housing Solutions: redlining, the wealth gap, and the narrative.

In October 2022, Front Porch Investments co-facilitated an afternoon of learning and exploration of solutions in the affordable housing ecosystem, including the impact of redlining, with the University of Nebraska at Omaha.

Ahead of launching the Greenlining Fund in Spring 2023, Front Porch Investments will be creating its inaugural cohort of the Community Advisory Committee (CAC), to bring together people who are currently living in areas impacted by redlining, or who have previously experienced the direct impact of redlining. The CAC will be created and invited to share in impact and decisions about future grants and funding disbursements in Omaha for the Greenlining Fund. The CAC's collective vote will have equal power to the vote of the Front Porch staff and vote of the Board of Directors for Front Porch Investments.

The Greenlining Fund will be launched Spring 2023. Its purpose is to not only to provide intentional reinvestment and direct resources to create or maintain homeownership in areas that have experienced historical disinvestment through redlining or other disadvantages, but to also proactively prevent future displacement of residents due to rising property valuations as a result of current and future investments and development in the community. The Greenlining Fund's impact will be realized through "purchase to payoff" support for homeowners and prospective homebuyers possibly including, but not limited to: down payment assistance, low interest home financing, home equity loans, property tax relief, debt consolidation, etc.

To watch the video replays of the afternoon, click below!

-

Documentary Screening: Following the premier release of Affordable Housing: the crisis in Omaha, a documentary from Digital Moxie, a panel discussion will commence. Tim Kenny will facilitate a discussion on the reality of housing instability in Omaha, joined by the following guests:

Alicia Christensen (Together)

Nicole Engels (City of Omaha)

Stephanie Hoesing (Omaha Public Schools)

Erin Feichtinger (Women's Fund) -

Robin Rue Simmons (Evanston IL) : Solutions Only” leadership: the model to advance local reparations policies.

-

Own It is a network of Madison WI area professionals in the real estate, banking, and financial industries committed to acknowledging harm and creating positive impact. Their team has joined together in pursuit of a common goal – to empower, educate, and guide communities of color towards homeownership, wealth, and financial freedom. We acknowledge the systemic racism embedded within financial systems, practices, and policies, and we are committed to exposing and eradicating these structural barriers.

-

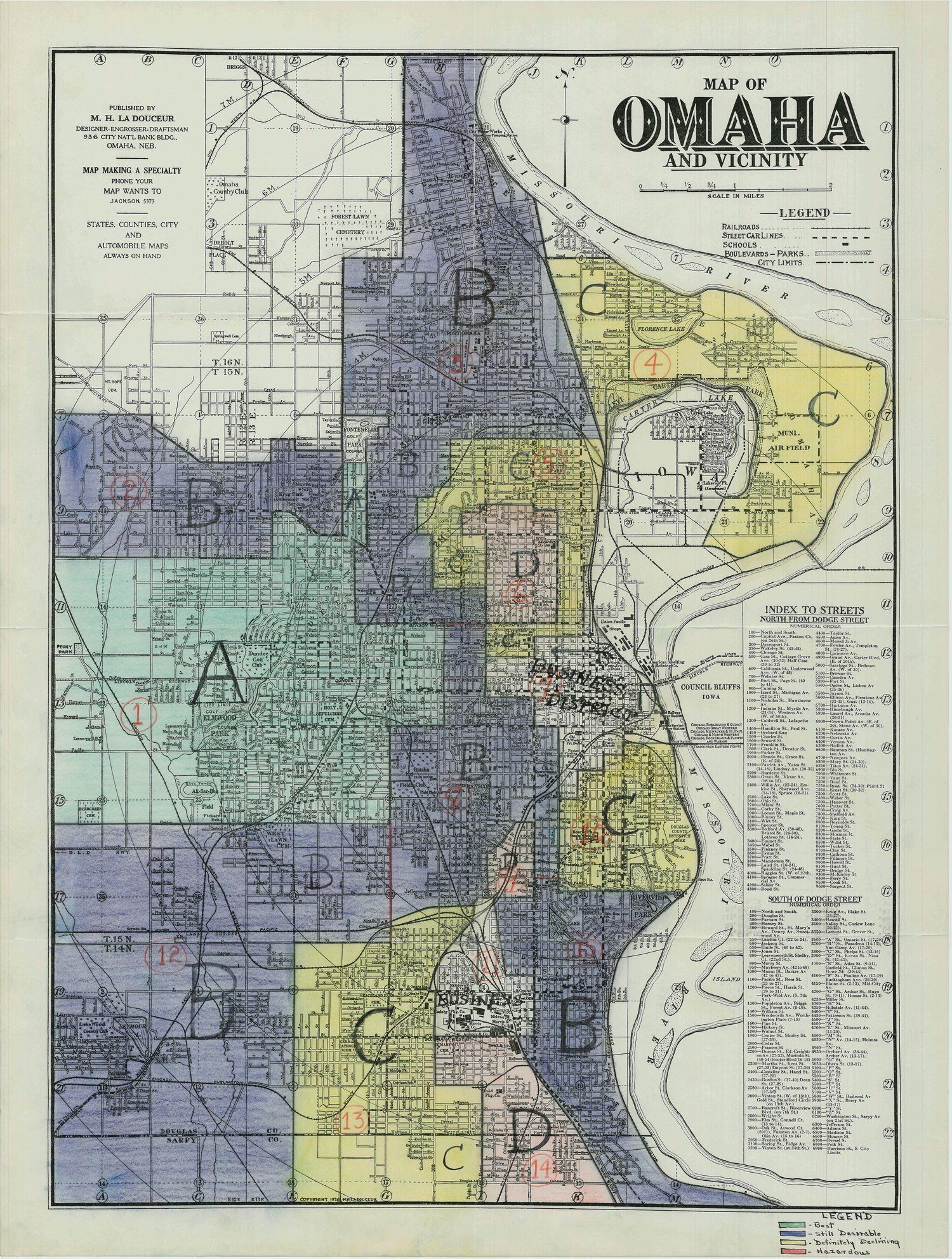

In 1935 the Omaha Home Owner Loan Corporation created a map that designated neighborhoods red, yellow, blue, or green—with red corresponding to “high risk” and green corresponding to “low risk.” Mortgage lenders based the level of home loan “risk” in each neighborhood on factors such as race and/or immigration status. In spite of the Fair Housing Act of 1968 — which broadly prohibits discrimination in the sale or rental of housing —, the redlines drawn around Omaha continue to hold strong, leaving long-lasting effects on communities today.

-

The Greenlining Fund will be launched Spring 2023. Its purpose is to not only to provide intentional reinvestment and direct resources to create or maintain homeownership in areas that have experienced historical disinvestment through redlining or other disadvantages, but to also proactively prevent future displacement of residents due to rising property valuations as a result of current and future investments and development in the community.

The Greenlining Fund's impact will be realized through "purchase to payoff" support for homeowners and prospective homebuyers possibly including, but not limited to: down payment assistance, low interest home financing, home equity loans, property tax relief, debt consolidation, etc.