Development and Preservation Fund

insert season and year - An ARPA funds partnership between the City of Omaha and Front Porch Investments

Front Porch Investments is excited to announce the launch of ---------- insert information about current fund / round / cycle -------- for mixed income and affordable housing projects (or phases of projects) and affordable housing programs.

In this round of funding, eligible projects include, but are not limited to:

- Gap financing for the development of new affordable housing and preservation of existing stock

- Acquisition and/or rehabilitation of current structures for adaptive reuse into affordable housing and mixed income housing units

- The creation of affordable housing in areas near job centers and transit

- Programs that support access to affordable housing

- Programs that support workforce development across the affordable housing sector

- Transformative and innovative or pilot projects that serve as catalysts in neighborhood revitalization

Through this partnership, the City of Omaha's $20 million investment of American Rescue Plan Act (ARPA) funds are being matched by Front Porch Investments through $20 million in philanthropic contributions. The Development and Preservation Fund will award funding to projects serving households earning less than 120% of area median income.

For a Word document version of the application (for language access or language translation purposes, or to assist in your application process), please email Tess@OmahaFoundation.org. All submissions must be completed however, in the Submittable platform.

ARPA funds must be spent by December 2026. The City and Front Porch Investments have developed a strategy to use a majority of the $20 million in ARPA funds twice before the deadline through one round of short-term loans followed by a round of grants to housing supportive nonprofits. These loans will be repaid in 2025, making the money available for a second time in the form of grants.

The first round of funding will include up to $10 million of ARPA funding distributed in low-interest loans for affordable and/or mixed income housing development or rehabilitation with a maximum loan term of 24 months. All loans will be available at a 1% fixed interest rate.

Eligible loan types include:

- Pre-development loans

- Acquisition loans

- Construction loans

- Bridge loans

Projects must fall within the boundaries of the City of Omaha. Projects outside of qualified census tracts must provide proof of additional amenities and or services such as access to transit or employment opportunities.

ARPA funding will support the creation or rehabilitation of units and/or projects for individuals and/or households at 120% Area Median Income ("AMI") or below. Mixed income projects can be funded at the percentage of affordability under 120% AMI.

Additional information about this funding:

- Nonprofit and for-profit developers are eligible

- All applicants must provide a Unique Entity ID (UEI) or proof of application from SAM.gov

- Funding can support activities related to new construction and/or rehabilitation/reuse for affordable housing projects, including single family and multi-family rental and for-sale units, with a minimum affordability period of 20 years

TIMELINE:

*For applicants with ready-to-go projects, we encourage you to submit your completed application by noon central standard on August 29th, to be eligible for the first review cycle.

All applications are due on September 13, 2022 at noon central standard. Awards will be announced in November, 2022.

STEP ONE: IMPORTANT: If you or your organization plan to apply, you must obtain a UEI by registering at SAM.gov. We highly encourage you to begin this process as soon as possible – there is no need to wait until the application cycle opens to get registered. We encourage you to start the process early as it can take some time.

STEP TWO: Watch the replay video of our informational workshop for prospective applicants, or review the slides from the presentation.

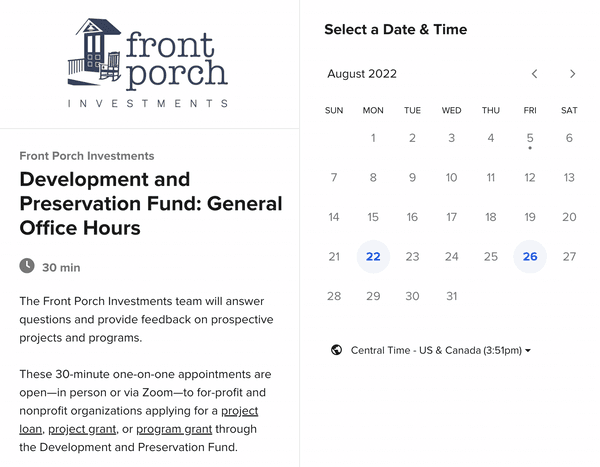

STEP THREE: Register for one of the upcoming open office hours! We are offering three optional opportunities for prospective applicants to ask general questions and/or seek assistance with supporting financial documentation during 30-minute one-on-one appointments.

- General Office Hours (click to see available dates on August 26) – The Front Porch Investments team will answer questions and provide feedback on prospective projects. These 30-minute one-on-one appointments are open—in person or via Zoom—to for-profit and nonprofit organizations applying for a project loan, project grant, or program grant through the Development and Preservation Fund.

- *Virtual* General Office Hours (click to see available dates on August 25 and September 2) – The Front Porch Investments team will answer questions and provide feedback on prospective projects. These 30-minute one-on-one appointments are open—via Zoom—to for-profit and nonprofit organizations applying for a project loan, project grant, or program grant through the Development and Preservation Fund.

- Underwriting Office Hours (click to see available dates on August 26) – Representatives from American National Bank and the Carver Legacy Center will assist prospective applicants with their financial loan documentation to help prepare for underwriting. These 30-minute one-on-one appointments are open —in person— to for-profit and nonprofit organizations applying for a project loan or project grant through the Development and Preservation Fund. Thanks to American National Bank and the Carver Legacy Center for contributing their time and space to support Development and Preservation Fund applicants!

STEP FOUR: Bookmark this website page, and be sure to join our email list!

STEP FIVE: Learn about the American Rescue Plan Act (ARPA).

Procurement Guidelines (for all projects that involve contracting/subcontracting)

Affordable Housing How-To Guide

– How to Use State and Local Fiscal Recovery Funds for Affordable Housing Production and Preservation - U.S. Department of the Treasury

Compliance and Reporting Guidance

– State and Local Fiscal Recovery Funds Guidance on Recipient Compliance and Reporting Responsibilities - U.S. Department of the Treasury

*We suggest independent review by legal experts.

STEP SIX: Review the following resources and information:

-

– Loan funding to support a nonprofit or for-profit development project (updated 8-14-2022)

-

– Grant funding to support a nonprofit development project (updated 8-14-2022)

-

– Grant funding to expand the parameters or capacity of a current program and/or support the launch of a new pilot or program (updated 8-14-2022)