We write this letter in response to the Philanthropy.com opinion piece published on June 16, 2023 by Renee Lewis Glover and Ron Terwilliger titled, On Juneteenth, Philanthropy Should Commit to Fixing a Still Staggering Wealth Gap Fueled by Housing Inequity.

Here at Front Porch Investments, an intermediary funding nonprofit in Omaha, Nebraska, we agree with the authors that philanthropy and nonprofit must come together to positively impact Black homeownership across the country, including to specifically combat the still-lingering impacts of redlining for communities who suffered harm.

- White Nebraskans own homes at a rate 37% higher than Black residents, and at a rate 20% higher than Hispanic residents.

- Black homeownership rates in Omaha, Nebraska are nearly 10% lower than national rates.

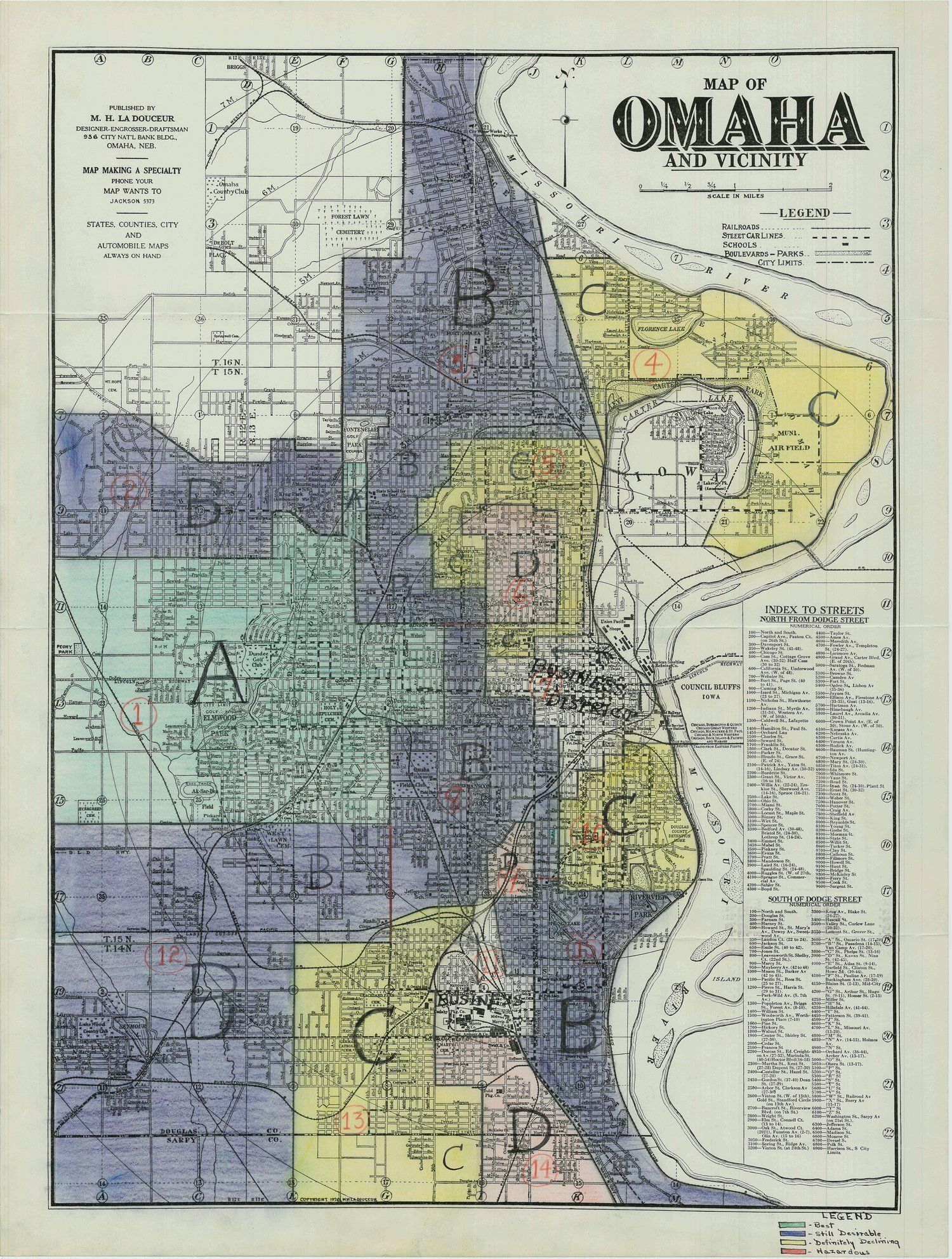

On Juneteenth 2023, Front Porch Investments launched a Greenlining Fund to provide intentional, community-led reinvestment to Eastern Omaha. The fund will direct resources to create or maintain homeownership in areas that have experienced decades of historical disinvestment through policies and practices including redlining. The first of its kind in Nebraska, the Greenlining Fund is also one of only a few national large-scale funds specifically focused on addressing deeply rooted systems of racial bias, discrimination, and segregation.

True impact lies in participatory decision making and shared power with those closest to the challenges and the solutions.

We have centered historically excluded voices in decision-making and program design within the Greenlining Fund. The inaugural cohort of the Community Advisory Committee, formed in November of 2022 with 14 community members, led in selecting the fund’s first pilot project, the Home Equity Loan Fund, and designed the program’s parameters, eligibility, and prioritization. The CAC is an incredibly strong element in this solution equation. The inaugural membership has been crucial to designing an equitable program and pilot launch. Future cohorts will continue bringing expertise (lived and professional) to the Fund.

We believe that ‘power with’ provides for more meaningful decisions, more sustainable solutions, and brings a community together in ways that often cannot be measured. We disrupt the notion of ‘power over’ and take every opportunity to offer our work with an open hand, and with many seats pulled up to the table.

While other programs exist across the country to offer home equity loans and property tax relief, the innovation of explicitly reinvesting in formerly redlined areas of a community and inviting members from that very community to share power and decision-making sets our Greenlining Fund apart. This intentionality and commitment to explicitly address past discriminatory housing policies sets precedent for future programming in Omaha, and in cities across the country.

The pilot program offers 0% interest rate home equity loans, up to a $50,000 maximum per property address, supporting homeownership stability and displacement efforts through home repair, exterior improvements, home renovation, modifications for aging in place, and energy efficiency improvements. Eligibility requirements include geographic location requirements (properties located in formerly redlined census tracts) and income considerations, with prioritization given to Black, Indigenous, and other people of color (of ancestry, race, and or ethnicity who were harmed and impacted by redlining practices). As home equity loan funds are repaid, the funds will revolve permanently in Qualified Census Tracts of North and South Omaha to support homeowners on the east side. The next area of focus for the Greenlining Fund will include research and investments for property tax relief and homestead exemption expansion as a potential displacement prevention strategy during a time of historic reinvestment in Eastern Omaha.

Philanthropy must seek long term outcomes, including both parity and equity concerning access to household and generational wealth.

Through the Greenlining Fund, we envision a powerful reduction of evictions, foreclosures, and the displacement of people and culture. We envision community members – many of which who have long lived in formerly redlined areas - enjoying the benefits of reinvestment, instead of continued trauma from increased property taxes and pressure from outside investors offering quick cash for their homes. We are issuing a bold call to philanthropy to increase accountability to community and truly show a dedicated investment priorities investment, trusting the community closest to the challenges to know best how to design solutions.

Front Porch Investments has committed $1M to the launch of the home equity loan fund pilot, with an additional $4M designated to future investments. Our organization is also a current semi-finalist for $3M in national funding through Enterprise and the Wells Fargo Foundation, to support the Greenlining Fund’s expansion into other impact programs. Front Porch Investments will continue to pursue local and national funding opportunities to continue to support this community-led fund and address racial equity issues in homeownership through the Greenlining work.

Relationships are crucial to our team’s success, and that is evident in the way we carry ourselves in the work. We use the word “braid” a lot in our day-to-day work, and it’s not accidental. Multiple strands of braided material are not only stronger but are easier to carry. We have a proven track record of partnerships with government entities, affordable housing supportive nonprofits, and look forward to bringing more collaboration to the table as we grow the Greenlining Fund.

As we begin evaluating the pilot launch of the Greenlining Fund through the home equity loan fund, one challenge experienced and noted was the request for buy-in of local funders, including banking institutions, private philanthropy, and corporations. We were quickly introduced to stagnant and status quo assumptions and restrictive belief systems from the public and funding community about not only the history of redlining, but opinions about their obligations and responsibility to past harm through the policies of redlining.

As the authors stated, philanthropy and housing nonprofits have a vital role to play in providing equitable access to wealth generation and housing stability. We are happy to be part of the solution and invite – directly -- others to take bold action.