We value fostering a collaborative environment where transformative change happens. Part of that transformative change comes about when our community operates from a shared language, and a defined set of terms and words that inform our work. We are excited to share our Glossary of terms, phrases, and words that we've done our best to define.

We know this glossary is not exhaustive, and we welcome your input if you spot something that should be included!

We've already covered the words and terms that fall in the A-P category! Read those articles

Finally, the words and terms that fall in the Q-Z category!

Note: any acronyms used throughout this Glossary will be also defined alphabetically by the phrase or word’s spelling (as opposed to alphabetically by the acronym).

Qualified Census Tracts (QCT)

Designated by Housing and Urban Development (HUD), or equivalent geographic area defined by the Census Bureau, where at least 50% of households have incomes below 60%.

Rapid Rehousing (RRH)

A program that rapidly connects households experiencing homelessness to permanent housing through a tailored package of assistance that may include the use of time-limited financial assistance and targeted supportive services.

Real Estate Investment Trust (REIT)

A company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, including office and apartment buildings, warehouses, hospitals, shopping centers, hotels and commercial forests. Some REITs engage in residential housing and/or financing real estate.

Regulations

Rules that affect the use of the land, such as zoning, land development, construction, and subdivision regulations. It also contains rules that permit an owner to divide their land into smaller tracts. These activities include barriers, such as exclusionary zoning, as well as solutions, such as bonus density zoning. It also includes private restrictions on the use of property, such as deed restrictions.

Rent Subsidies and Operating Subsidies

Funds that make it possible to build affordable housing, usually from the government or a public body.

Safe Haven (SH)

A form of supportive housing that serves hard-to-reach homeless persons with severe mental illness who come primarily from the streets and have been unable or unwilling to participate in housing or supportive services.

Section 8 Housing (Project Based)

Many Section 8 contracts have expired or will expire soon, and the property owners must now decide whether to renew their contract or leave the program ("opt out"). Most of these contracts are now renewed on a one-year basis. Projects with high risk of opting out typically have rents set by the Section 8 contract below the prevailing market rents for comparable units. Owners thus have an incentive to leave the program and convert their property to private market rentals. In the Omaha & Council Bluffs area, there are 2,760 units leased as project-based section 8. Households must have incomes at or below 80% of AMI. Sometimes, an apartment or entire community may only be available for tenants of a specific demographic, such as elderly or disabled persons. In Omaha, a third of all households utilizing project-based vouchers belong to a minority group. The Housing Authority may enter a HAP contract with an owner for an initial term of up to 15 years and an extension of the initial term of up to 15 years. After one year of assistance, a family may switch to the housing authority’s tenant-based voucher program when the next voucher is available, or to another comparable program if such a program is offered.

Section 8 Housing (Tenant Based)

Housing authorities receive funding from the federal government to give vouchers to individual families. Families use these vouchers—which cover a portion of their rent—with property owners (landlords) in the private rental market. In exchange, property owners receive rent payments from the housing authority. In the Omaha & Council Bluffs area, 10,960 households use tenant-based vouchers. In every community, there is a year-long waitlist of people who are eligible for section 8 but for whom there are not enough vouchers.

State and Local Tax Policies

Barriers and solutions which impact housing affordability, and include laws related to property taxes, tax assessments, transfer taxes, and sales taxes on building materials. It also refers to tax abatements or concessions and homestead exemptions.

Subsidized Housing

A generic term covering all programs that reduce the cost of housing for low- and moderate-income residents. Subsidies are common from the government to individuals or groups for activities that the government wants to encourage (the government gives money to farmers who grow corn, for instance, and so more farmers grow more corn than otherwise would). Subsidized Housing does not mean affordable housing. Any time the government shares the costs of housing with developers, property owners (landlords), tenants, or homeowners, it is subsidized housing. If we take the term at its most basic meaning – housing that receives some form of subsidy – it is hard to find housing that is not subsidized. Housing can be subsidized in numerous ways—giving tenants a rent voucher, helping homebuyers with down payment assistance, reducing the interest on a mortgage, providing deferred loans to help developers acquire and develop property, giving tax credits to encourage investment in low- and moderate-income housing, authorizing tax-exempt bond authority to finance the housing, providing ongoing assistance to reduce the operating costs of housing and others.

Subdivision

In the literal sense, a subdivision is a plot of land, divided into lots. A plat is already a divided piece of land, and lots are created by dividing that land accordingly; hence, the name subdivision. Many people know subdivisions at their most developed points when they have infrastructure, roads, and homes.

Supplemental Security Income (SSI)

A federal income supplement program funded by general tax revenues (not Social Security taxes). It is designed to help aging and disabled people who have little or no income by providing cash to meet basic needs for food, clothing, and shelter. It is a $763 per month benefit.

System Performance Measure (SPM)

A report that focuses on viewing the local homeless response as a coordinated system of homeless assistance options as opposed to homeless assistance programs and funding sources that operate independently in a community. Performance is measured as a coordinated system, in addition to analyzing performance by specific projects or project types.

Tax Increment Financing (TIF)

A form of public financing that leverages future tax benefits for real estate subsidies or improvements to pay for current improvements/subsides. This method is used to spur development, stability and address blighted areas. Funding for TIF is often drawn from property taxes or sales tax.

Transitional Housing (TH)

A program that provides temporary housing with supportive services to households experiencing homelessness with the goal of interim stability and support to successfully move to and maintain permanent housing.

Transit-Oriented Development (TOD)

A type of mixed-use housing development close to public transit such as frequent bus lines, etc. TOD is usually within 1/4 to 1/2 mile of a transit station or major bus line.

Underserved Populations

Examples include:

Persons living below the poverty line

Excluded and/or marginalized populations and/or communities

Persons with disabilities

Migrants and/or displaced persons

Undereducated

Underserved, owing to a lack of quality access to essential goods and services

Women and/or sexual and gender minorities

Aging populations and/or vulnerable youth

Other vulnerable groups, including refugees because of natural disasters

Universal Design

The design of buildings, products or environments to ensure they are, or to make them, accessible to all people, regardless of age, disability or other factors. Proponents of universal design advocate that it is not a special requirement, for the benefit of only a minority of the population, but that it is a fundamental condition and good design.

U.S. Department of Housing and Urban Development (HUD)

A U.S. government agency created in 1965 as part of then-President Lyndon Johnson’s Great Society agenda to expand America’s welfare state. Its primary mission is improving affordable homeownership opportunities to support the housing market and homeownership. HUD’s programs are geared toward increasing safe and affordable rental options, reducing chronic homelessness, fighting housing discrimination by ensuring equal opportunity in the rental and purchase markets, and supporting vulnerable populations.

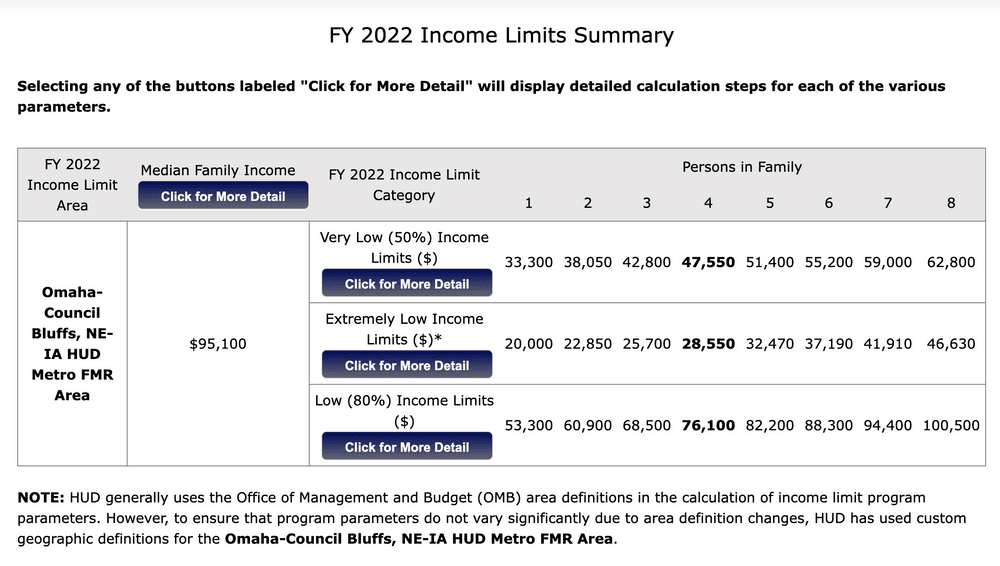

Workforce Housing (see HUD Income Categories)

Workforce Innovation and Opportunity Act

The primary federal workforce development legislation intended to increase coordination among federal workforce development and related programs. WIOA provides comprehensive change to several employment and education-related programs, including services for people with physical, intellectual, and developmental disabilities.

Yes, In My Backyard (YIMBY)

A neighborhood group, or person, who supports equal access to housing, including low-income housing built near their homes.

~

Note: We value learning at Front Porch Investments and prioritize opportunities to continue our learning path. We will update this Glossary as we expand our awareness and seek to be as inclusive as possible! On that note, what did we miss? Email us at FrontPorch@OmahaFoundation.org to let us know what terms, words, or concepts we need to add to our Glossary!

To read the other segments of our Glossary, visit the Words Matter series.