0% interest Home Equity Loan Fund

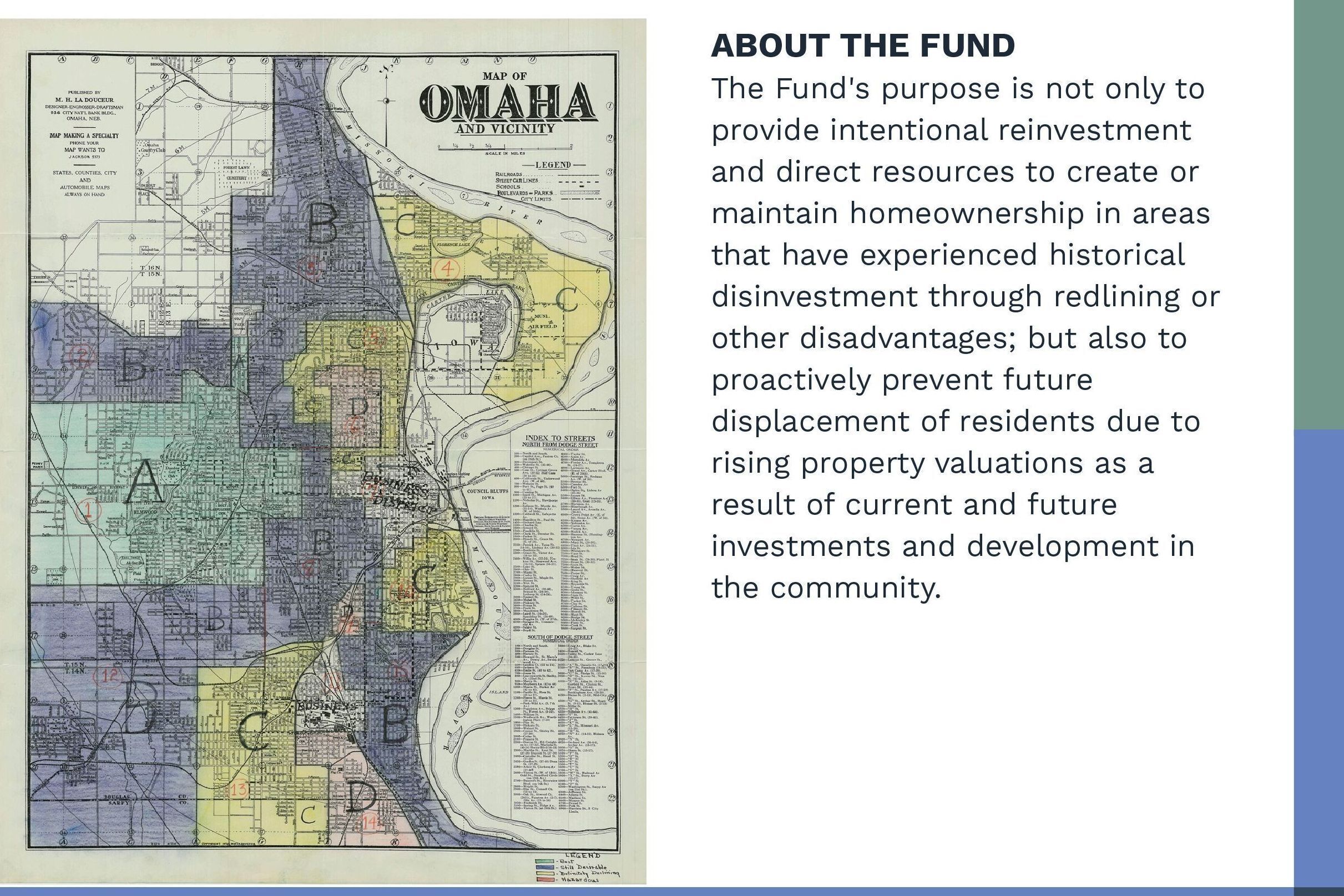

The Front Porch Investments' Home Equity Loan Fund (HELF) is designed to assist households with home repair and home renovation by providing zero-interest financing, fully amortized over a 30-year term, administered in partnership with Impact Development Fund, serving as the direct-to-consumer loan originator and servicer in accordance with consumer lending regulations. Front Porch Investment’s (FPI) Greenlining Fund is an opportunity to provide intentional reinvestment and direct resources to create or maintain homeownership in areas that have experienced historical disinvestment through redlining or other disadvantages.

The Home Equity Loan Fund launch period has now closed.

Eligible homeowners were able to submit their Program Eligibility Interest Form from June 19th - July 10th, 2023, through an online form. Front Porch Investments (FPI) received 227 Interest Forms for the Pilot launch. Eligible interest forms will be selected from the prioritization and notified through email and in writing via USPS no later than July 21st, 2023, with an invitation to apply for a loan through Impact Development Fund. If FPI receives multiple interest forms with the same score, we will utilize a random number generator to select up to 40 homeowners. Non-eligible homeowners and those not randomly selected will be notified via email and in writing via USPS no later than July 28th, 2023.

ADDITIONAL HOMEOWNER RESOURCES from community partners:

City of Omaha Resident Housing and Rehab services

Pilot launch history and prior details:

The HELF offers 0% interest loans, up to a $50,000 maximum per property address. Loan amount is subject to available funds, with eligibility factored from debt-to-income ratios and loan-to-value ratios. Funds may be used for home repair, exterior improvements, home renovation, modifications for aging in place, and energy efficiency improvements. Funds will be disbursed in accordance with contractor invoices and/or vendor receipts. The payment schedule and required documentation will be developed and approved based on the scope of work with the Applicant and FPI. The Contractor must be licensed and insured. Funds will be disbursed directly to the Contractor.

Eligibility for Borrowers:

- at least 19 years of age

- be lawfully present in the United States, possessing SSN or ITIN.

- be the owner of a residential single-family home, occupied as primary residence.

- income may not exceed 120% of area median income (“AMI”) for the Omaha Metro, adjusted by household size, using HUD Omaha-Council Bluffs, NE-IA Metro FMR Area.

- residential real estate location must be located in the formerly redlined census tracts in Northeast or Southeast Omaha, Nebraska. See GIS Map / Address Lookup Tool .

Prioritization:

- Black, Indigenous, and other people of color (of ancestry, race, and or ethnicity who were harmed and impacted by redlining practices)

- Residential real estate is located within a census tract formerly marked Hazardous (red)

- Over the age of 59 years

- Length of tenure in the area

Home Repair and Home Improvement Examples (projects may include the following; however, this list of examples is not complete, exclusive, or exhaustive. Other home improvements projects may be acceptable):

- Interior or exterior remodeling or beautification (landscaping and external amenities);

- Items providing greater accessibility (egress ramps, grab bars, mobility modifications);

- Structural, electrical, mechanical, plumbing, fire prevention improvements/corrections;

- Items to lengthen the useful life of structure (e.g. roof replacement, siding replacement);

- Items that conserve energy (installing water-saving fixtures, installing energy-efficient furnaces or other major mechanical equipment, and/ or window replacement;

- The creation of new or additional habitable space.

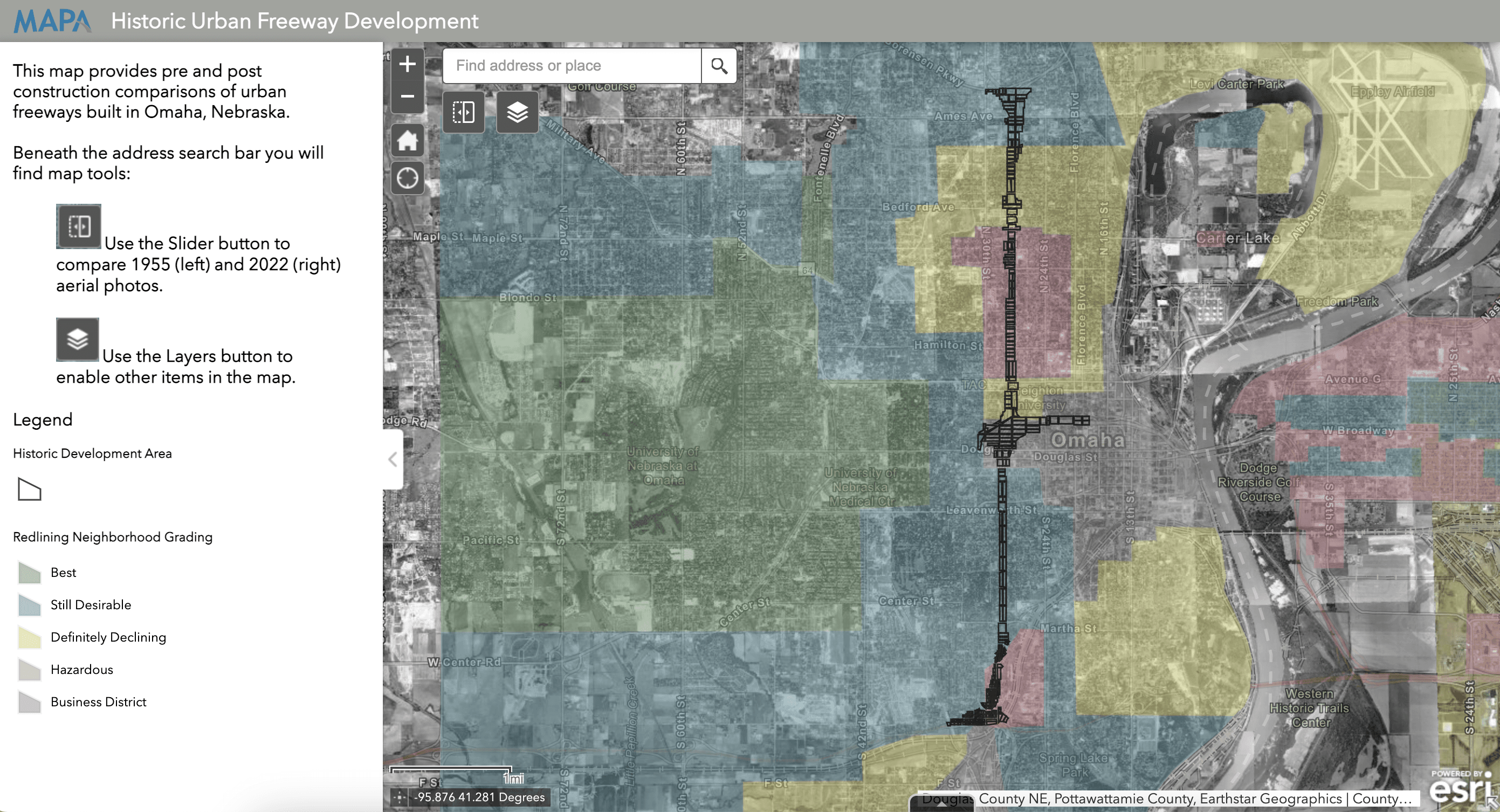

Please note that the Lookup Tool will not specifically indicate whether an address is eligible for HELF funds. When using the Lookup Tool, the transparent color overlay throughout the map will match the "neighborhood grading" color code key on the lower left-hand side of the Lookup Tool. For example, 4111 N. 39th Street has a blue map color, correlating to the "still desirable" color code of the previous redlining map. 2107 Pinkney has a yellow map color, correlating to the "definitely declining" color code. 2221 Lake Street as a red map color, which correlates to the "hazardous" color code. Eligibility for the HELF fund requires that a property address be located in a red map color, previously identified as "hazardous".

To look up the address of a property, and determine if it is located in a formerly redlined area, use the lookup tool. Enter the address in the search bar. Green indicates areas formerly identified as "best", blue indicates areas formerly identified as "still desirable", yellow indicates areas formerly identified as "definitely declining" and red indicates areas formerly identified as "hazardous."

GREENLINING FUND HISTORY:

Front Porch Investment’s (FPI) Greenlining Fund: an opportunity to provide intentional reinvestment and direct resources to create or maintain homeownership in areas that have experienced historical disinvestment through redlining or other disadvantages. The Greenlining Fund was a recommendation in the Omaha and Council Bluffs Area Assessment of Housing Affordability, Needs, & Priorities report, funded in collaboration with nine other local foundations. Deeply rooted systems of racial bias, discrimination, and segregation have caused great inequity for Omahans. Because this fund targets specific geographic areas, heavily populated by historically excluded voices, FPI is prioritizing participatory grantmaking and program design.

DECISIONS:

The Community Advisory Committee (CAC) was founded in November of 2022 with 14 community members. While other programs exist across the country to offer home equity loans and property tax relief, the innovation of explicitly reinvesting in formerly redlined areas of a community, and also inviting members from that very community to share power and decision-making sets FPI’s Greenlining Fund apart. This intentionality and commitment to explicitly address past discriminatory housing policies can set precedent for future programming in cities across the country.

The initial Greenlining Fund pilot program is the home equity loan fund. Individuals will be qualified through a process established in partnership with the CAC. After the initial pilot program for home equity loans is completed, the CAC will evaluate the current program and make recommendations for changes or improvements to the program, as well as recommendations for future investments in the community based on applications received and feedback from applicants and community members.

IMPACT:

As home equity loans are repaid, the funds revolve permanently in Qualified Census Tracts in North and South Omaha. FPI partners with Impact Development Fund (IDF), a nonprofit CDFI with decades of experience in providing loans for affordable housing programs, to originate, monitor and service the loans as well as provide monthly reporting on all loan payments. Front Porch Investments will continue to pursue local and national funding opportunities to continue to support this community-led fund and address racial equity issues in homeownership through the Greenlining work.

Activities, research, data, and outcomes from this pilot will serve to support economic recovery for the area, providing needed information for the administrators of the program, future outreach and support initiatives, and potential advocacy for future policy changes.

To learn more about specific terms, phrases, or words, please review our Glossary of Terms: